英国知名咨询企业普华永道国际(Pricewaterhouse Coopers International, PwC)的市场调查结果显示,2010年全球可再生能源相关企业的合并与收购(M&A)金额为334亿美元。尽管2009年的M&A金额为488亿美元,多于2010年,但2010年的并购案数量却比2009年增加。

2010年欧洲的可再生能源领域M&A金额为130亿美元,减至上年的一半以下。而2010年北美在该领域的M&A金额却比上年增加43%,达到了129亿美元,与欧洲相当。顺便一提,亚太地区为35亿美元,南美为33亿美元。

在2010年可再生能源领域的M&A金额中,能源效率相关M&A金额最多,为30亿美元。而2009年并购金额最多的却是水力领域。据PwC介绍,2010年能源效率相关的M&A增加尤为显著的是北美市场。PwC公司可再生能源与清洁技术主管罗南·欧里根(Ronan O'Regan)表示,“关于可再生能源领域的M&A,估计今后几年内美国会占支配地位”。其原因是,除了可较为轻松地改善能源效率之外,美国消费者对能源效率的关注度在提高,而且美国政府采取的经济刺激政策也起着推动作用。

核电相关企业的M&A活跃

关于2010年可再生能源领域的M&A,PwC指出,美国及法国核电相关企业的M&A举动十分引人注目。比如,美国核电企业爱克斯龙(Exelon)2010年以9亿美元的价格收购了在美国迪尔(Deere&Company)旗下从事风力发电业务的美国约翰迪尔可再生能源(John Deere Renewables)公司。

PwC的欧里根表示,这是核电相关企业基于希望实现自身服务多样化而采取的行动。“(东日本大地震引发的)日本核电站事故也是应该考虑的问题。尽管核能投资本身并未亮起红灯,但估计短期内核电企业涉足可再生能源领域的活动会活跃起来”(里根)。(记者:Phil Keys,硅谷支局)

Renewable M&As: deals market rallies as confidence returns Strong growth in energy efficiency deals globally

US deal market bounces back to equal European transactions

Significant deals bring nuclear energy companies into renewables market

Regulatory uncertainty slows down deal activity in certain markets

London, 28 Mar 2011 -- North America’s switch on to energy efficiency has driven their position in the global renewable M&A market in the last 12 months, and could act as a driver for the region to become the dominant renewables market within three years, according to new analysis by PwC.

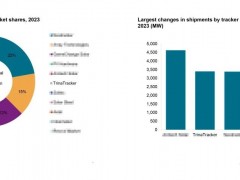

PwC Renewables Deals, the annual sector analysis of M&A transactions globally, reports that globally volumes of transactions in the sector were up, but overall values were down to US$33.4bn (2009: US$48.8bn). Across the world, market interest returned, with North America bouncing back to almost match deal values in Europe in 2010, with close to US$13bn spent on 181 deals.

Ronan O’Regan, director, renewables and cleantech, PwC said:

“Strong confidence has come back to the market after financing issues caused the sector real problems in 2008 and 2009. In addition, in 2010 buyers and sellers expectations are more realistic, which has supported higher deal volumes.

“We expect confidence levels to remain relatively strong throughout 2011, despite regulatory uncertainty in some markets.”

Globally, energy efficiency deals trebled in volume to represent over $3bn, or 11%of all renewable transaction value, overtaking last year’s dominant market segment, Hydro power. Overall, wind and solar power continue to dominate global transactions in the sector. The US market dominated growth in the energy efficiency market in 2010 reflecting both the potential for energy savings per capita, and renewed regulatory interest, such as new US building codes aimed at delivering a 30% energy saving in new builds.

Ronan O’Regan, director, renewables and cleantech, PwC said:

“The growth in energy efficiency deals is not surprising, particularly in North America, because when you’re trying to reduce emissions, it’s where the quick wins can be found. There’s increasing consumer awareness around managing energy usage which, when supported with appropriate regulations, is creating an attractive market for energy efficiency service providers. This, combined with government stimulus packages, should see the US become a dominant player in the renewables deal market over the next few years.”

In other significant moves, market activity by US and French nuclear power generators and engineering firms into wind and solar sectors, are part of a wider move for the nuclear sector to extend its reach in renewables, further developing their low carbon offering.

Ronan O’Regan, director, renewables and cleantech, PwC said:

“Many of these moves by nuclear companies are driven by diversification. The reaction to the Japanese nuclear situation has been to take stock. While it won’t raise a red flag to investment in nuclear, it could in the short term spur further moves by nuclear companies into renewables.”

Despite increased transaction volumes, the ‘green premium’ on renewables deals - the price investors were willing to pay for a business with products exposed to the renewables sector has narrowed, partially due to sellers’ lowering their price expectations, and partially due to greater stability in the economy.

Power utilities purchases were down to a third of previous levels, in part due to regulatory reviews in Spain, Germany, Italy and the UK, but also as their focus has switched to delivering on massive capital investment challenges.

The largest deals were dominated by the flow of renewables flotations, including the $3.4bn spin-off of Enel’s green energy arm, and Chinese transactions, raising valuable capital for reinvestment in product and market development.

Ronan O’Regan, director, renewables and cleantech, PwC concluded:

“The recent return to US$100+ priced oil and the reaction to the nuclear tragedy in Japan should provide some support to valuations and act as a timely reminder to governments that a shift to a low carbon economy is not only about its environmental commitment, but also about security of supply.”

Notes

Renewables Deals includes analysis of all global renewable energy and clean technology M&A deal activity. This year, the analysis is based on transactions from Clean Energy pipeline’s proprietary M&A database, provided by Venture Business Research. Figures relate to the actual stake purchased and are not grossed up to 100%. The analysis also includes deals with undisclosed value. Deals where the transaction value is undisclosed are assigned an average transaction value using a methodology derived from Clean Energy pipeline’s proprietary M&A data.

Deal volumes and values:

- European deal volumes rose 50%, but overall values fell by over half to US$13bn

- North American deal volumes rose 71%, with deal values rising 43% to US$12.9bn

- South American deal volumes rose 111%, with values more than doubling to US$3.3bn

- Asia Pacific (including Australasia) deal volumes almost doubled, but values fell by half to US$3.5bn

Nuclear investments in renewables: In the US, the $900m purchase of John Deere Renewables by nuclear power generator Exelon demonstrates the evolution of wind power and its integration into mainstream power generation. It’s Execlon’s first move into owning and operating wind project, and gives the company more options for future growth given the lack of momentum in US nuclear power development. The French nuclear engineering company Areva made its first move into the solar power market with a US$200m purchase of US company Ausra, a developer of solar thermal power technology

PwC firms provide industry-focused assurance, tax and advisory services to enhance value for their clients. More than 161,000 people in 154 countries in firms across the PwC network share their thinking, experience and solutions to develop fresh perspectives and practical advice. See pwc.com for more information.

"PwC" is the brand under which member firms of PricewaterhouseCoopers International Limited (PwCIL) operate and provide services. Together, these firms form the PwC network. Each firm in the network is a separate legal entity and does not act as agent of PwCIL or any other member firm. PwCIL does not provide any services to clients. PwCIL is not responsible or liable for the acts or omissions of any of its member firms nor can it control the exercise of their professional judgment or bind them in any way.

2011 PricewaterhouseCoopers. All rights reserved.

微信客服

微信客服 微信公众号

微信公众号

0 条